A Mutual Fund is a trust that pools together the savings of a number of investors who share a common financial goal. The collective amount is then invested by professional fund managers according to the investment objective of the fund. Each fund based on the asset category could invest in stocks, bonds, money market instruments, gold and other similar assets.

According to the amount of investment in the Mutual Fund Scheme, the investor is allocated units of that Mutual Fund scheme. The income earned through these investments and the capital appreciation realized by the scheme is shared by the investor in proportion to the number of units owned by them.

Types of Mutual fund

Based on the Structure

- Open End funds - An open-end fund is a mutual fund scheme that is available for subscription and redemption on every business day throughout the year.

- Closed-End funds - A Closed-end fund is a mutual fund scheme that is available for subscription only during the initial offer period and can be redeemed only on maturity. However the Units of this fund would be listed on a stock exchange after the new fund offer, and investors can buy/sell this unit in the stock exchange.

Based on the Management Style

1. Actively Managed funds- Fund managers buy and sell investments, attempting to generate higher risk-adjusted returns than the benchmark.

2. Passively Managed funds- Funds managers buy a portfolio that tracks benchmark performance.

Based on the asset class

- Equity funds- Funds that invest in Equity shares are called Equity funds. They carry the principal objective of capital appreciation of the investment over medium to the long term investment horizon.

- Balanced Funds- Funds that invest in a mix of Equity shares and debt (fixed income) instruments. They strive to provide both growth and regular income.

- Debt Funds- Funds that invest predominantly in rated debt / fixed-income securities like corporate bonds, debentures, government securities, commercial papers, and other money market instruments.

- Other funds- All investments other than traditional asset classes (Equity & Bond) are categorized as alternative investments. Mutual funds offer funds in which investors can invest in alternative assets like gold, real estate, etc. We categorize these funds into the basket of other funds. These funds have different risk/return profiles compared to Equity & Debt funds, this could fit well in a portfolio context.

Mutual Fund Receivable

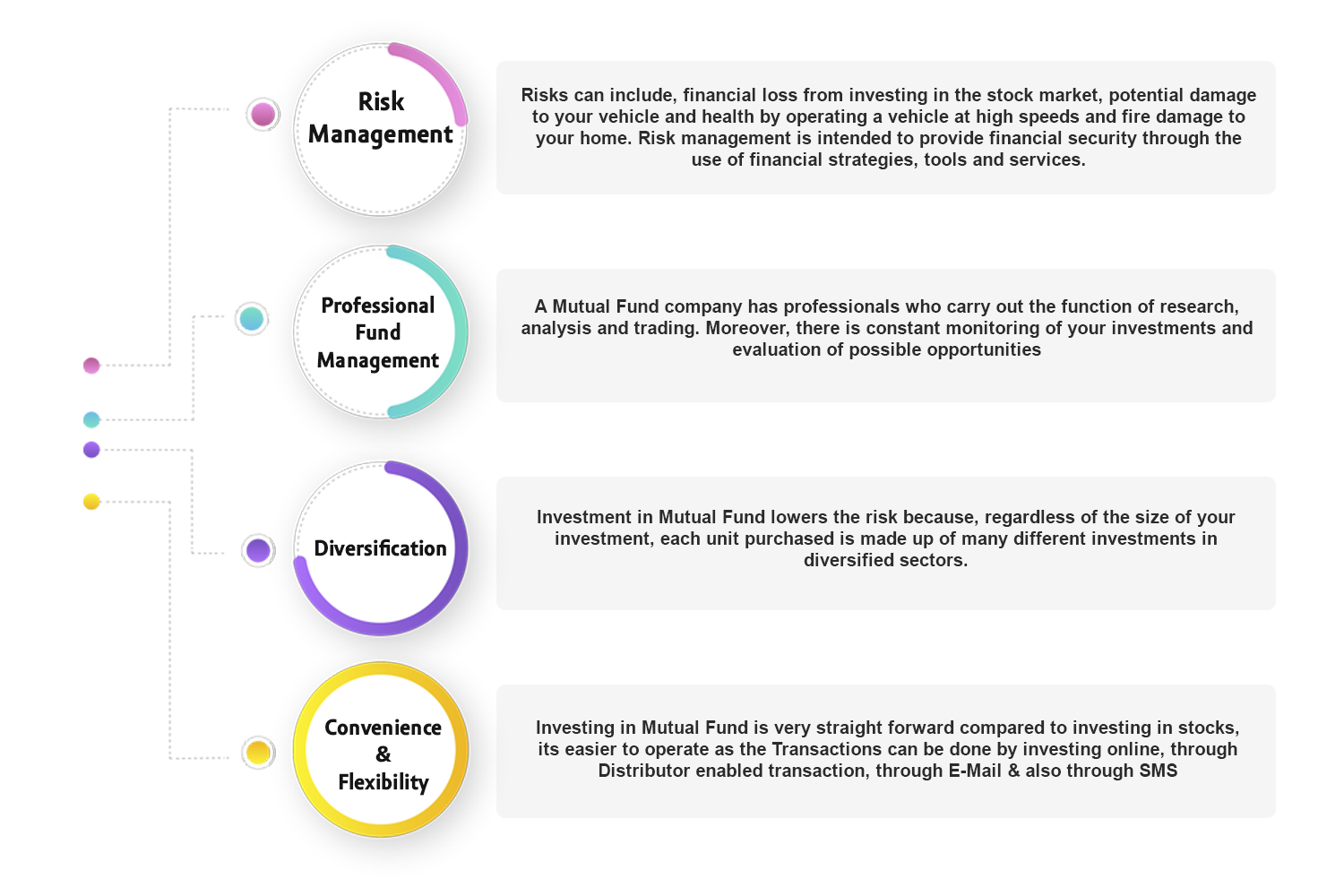

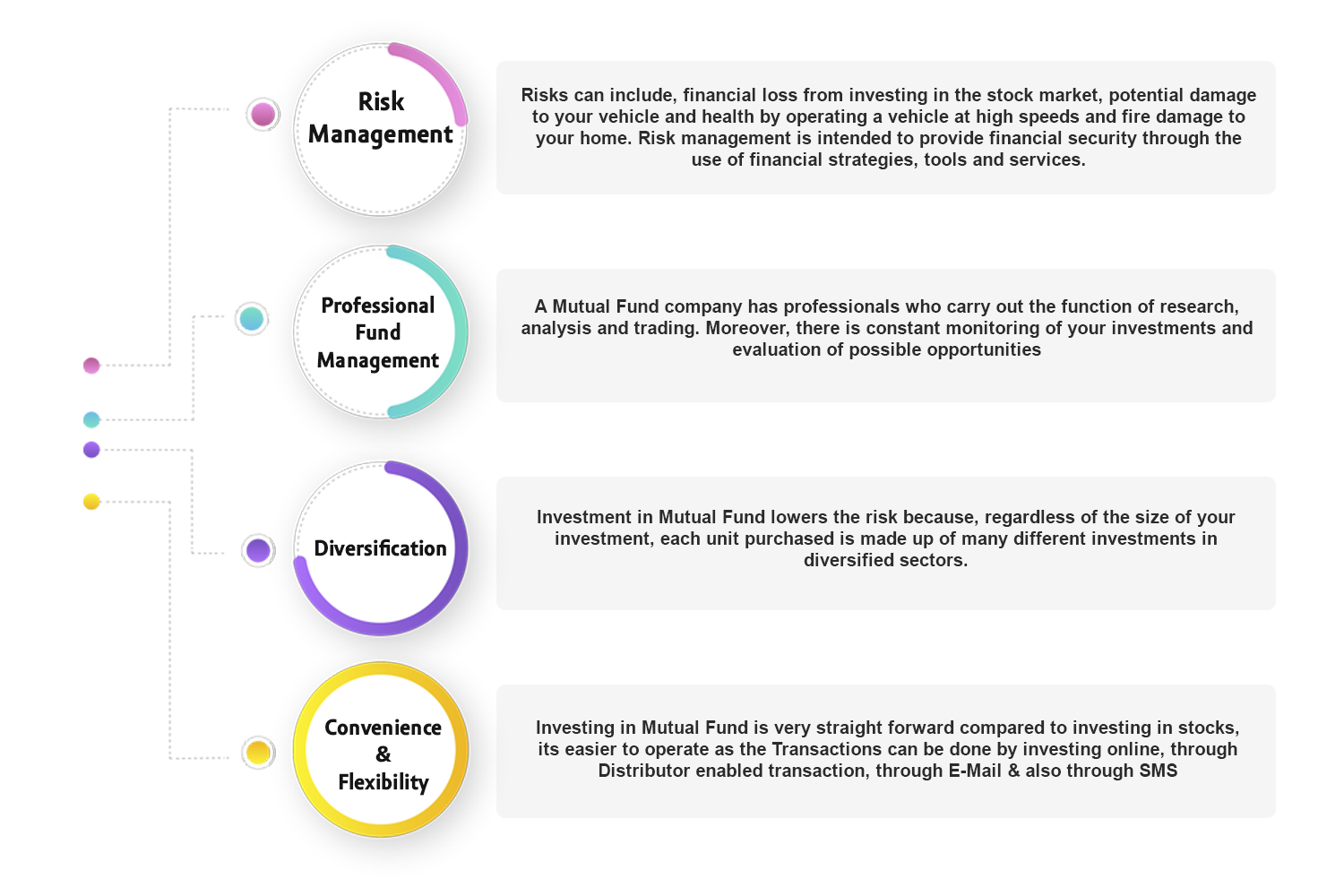

Why Mutual Funds